You can make a lot of money by starting a real estate business and helping people buy or sell homes. However, before you jump in head first, you should take some time to understand what it means to be an agent and how to become one.

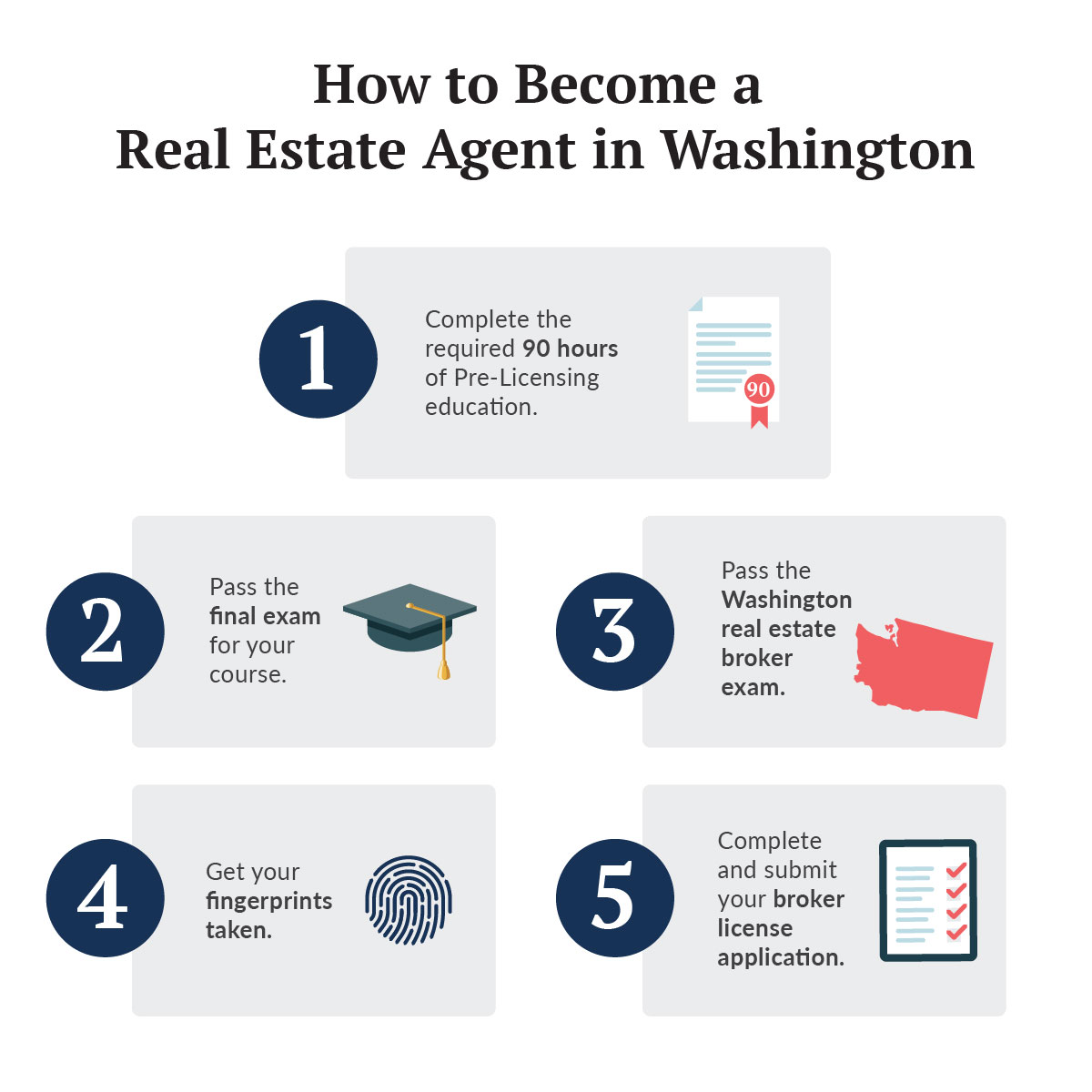

Begin by taking your pre-licensing class and getting your license. This can take you between 20 and 200 hours, depending upon your state. It is also possible to pay different tuition fees so it is important that you save some money before you start your real estate career.

The most common way to generate profit in a real estate business is through appreciation of the asset. This is when the value of your investment increases over time due to a number of factors, such as demand and inflation. Your business can also generate rent.

Marketing your business is essential. Many real estate agents acquire this skill on the job, or through classes at local colleges and universities. It is possible to hire an expert to assist with the marketing process.

Build Your Network

To be successful in the realty business, you must build strong relationships. These relationships are essential to building your brand and generating leads and sales. It takes patience and a lot work to maintain these relationships. But the rewards can be great.

You must start building a list of potential clients and contacts to establish these relationships. Keep their email addresses and names in a spreadsheet. Then, you can easily reach out to them to schedule a meeting or phone call.

It is important to make efforts to network with other professionals in the field such as real estate lawyers, brokers, and salespeople. These mentors can help you become a better agent.

A Plan is needed

It is important to develop a plan of action and set goals for your real estate career. Having clear goals can help keep you focused and motivated. These goals can also help you to determine the next steps, such as what types of properties or marketing methods to use.

If you need help getting started or finding the right path to success, don't hesitate to ask. There are many opportunities in the realty industry for intellectual growth, personal development, and a rewarding career with high potential earnings.

It is important to focus on the bigger picture, and not the little details. This will help you grow your business and not waste time or resources on unnecessary things.

You should have a clear picture of your company and the goals you are trying to achieve. This could be sales numbers or net income. You should be able to write these goals down and track them regularly, so that you can adjust your strategy as needed.

FAQ

How long does it take for my house to be sold?

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It may take up to 7 days, 90 days or more depending upon these factors.

Should I use a mortgage broker?

A mortgage broker can help you find a rate that is competitive if it is important to you. Brokers are able to work with multiple lenders and help you negotiate the best rate. However, some brokers take a commission from the lenders. Before signing up for any broker, it is important to verify the fees.

Do I need to rent or buy a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting will allow you to avoid the monthly maintenance fees and other charges. The condo you buy gives you the right to use the unit. The space is yours to use as you please.

What should I consider when investing my money in real estate

First, ensure that you have enough cash to invest in real property. If you don’t have the money to invest in real estate, you can borrow money from a bank. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

It is also important to know how much money you can afford each month for an investment property. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be best if you lived elsewhere while looking at properties.

How much money can I get to buy my house?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

How do I calculate my rate of interest?

Market conditions can affect how interest rates change each day. The average interest rate for the past week was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How do you find an apartment?

When moving to a new area, the first step is finding an apartment. This takes planning and research. This includes researching the neighborhood, reviewing reviews, and making phone call. While there are many options, some methods are easier than others. Before renting an apartment, you should consider the following steps.

-

You can gather data offline as well as online to research your neighborhood. Online resources include websites such as Yelp, Zillow, Trulia, Realtor.com, etc. Local newspapers, real estate agents and landlords are all offline sources.

-

See reviews about the place you are interested in moving to. Yelp. TripAdvisor. Amazon.com have detailed reviews about houses and apartments. You might also be able to read local newspaper articles or visit your local library.

-

You can make phone calls to obtain more information and speak to residents who have lived there. Ask them about their experiences with the area. Ask them if they have any recommendations on good places to live.

-

You should consider the rent costs in the area you are interested. You might consider renting somewhere more affordable if you anticipate spending most of your money on food. If you are looking to spend a lot on entertainment, then consider moving to a more expensive area.

-

Learn more about the apartment community you are interested in. For example, how big is it? How much does it cost? Is it pet friendly? What amenities does it have? Can you park near it or do you need to have parking? Are there any special rules that apply to tenants?